The Casino Group has stepped up its partnership with multi-channel mobile payment solution provider Lyf Pay and will acquire an initial interest of 5% in Lyf’s share capital.

The investment follows a period of close collaboration, initiated in 2017, during which the Casino Group and Lyf Pay developed innovative mobile payment-related solutions for use in Géant hypermarkets and Casino supermarkets across France, particularly via the Casino Max mobile app. The innovations include combined payment and loyalty services, deferred payment, payment in instalments for food shopping, and the Scan Express solution enabling shoppers to avoid queuing at the checkout.

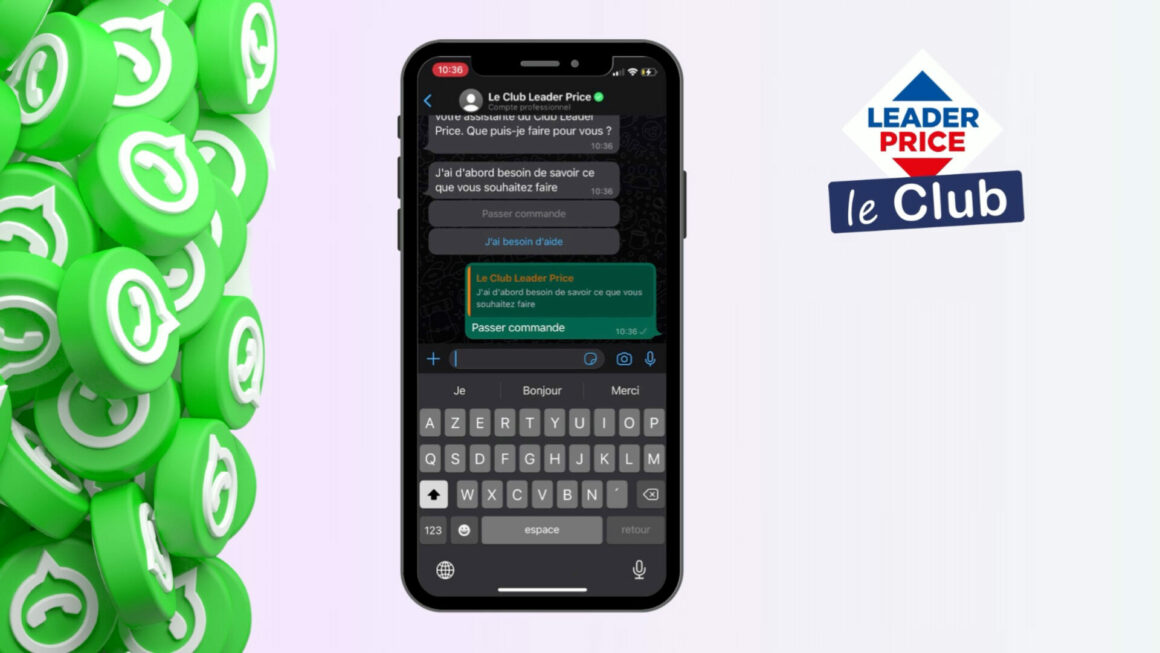

After being successfully deployed at Géant hypermarkets and Casino supermarkets in an initial phase (to cover a total of more than 500 stores), the Lyf Pay solution will continue to be rolled out over the coming months across the Group’s other banners: Le Petit Casino, Leader Price, Franprix, Monoprix, and Naturalia.

Cyril Bourgois, who heads up digital transformation and innovation for the Casino Group, said: “With this building-block partnership, the Casino Group and its banners are going to speed up joint development of a highly secure, digital mobile payment solution that will be available in all of the Group’s stores in France. The goal is simple; we want to provide our customers with a fast, seamless, all-inclusive payment experience like the one already offered via the Casino Max app. With just one click on their smartphone, our customers should be able to pay for their items (now or later), use their loyalty benefits and vouchers, and get their receipts in the app or by e-mail, completely eliminating the need to bring a purse or wallet to our stores.”

The aim of the partnership is to leverage new consumer behaviours to make everyday life easier for customers by providing them with an omni-channel shopping experience (thanks to a payment method that works in all stores and online) that is easier (because it combines payment, loyalty and ultimately other services), faster (less time spent at the checkout) and more personalised (because customers will receive targeted promotional offers). In this way, customers will each have access to their loyalty account, as well as their chosen payment methods and the associated financial services (such as payment in instalments) directly via the banner and/or the Lyf Pay app.

“This partnership confirms the Lyf Pay solution’s unique positioning at the crossroads of the payment and retail ecosystems,” said Christophe Dolique, Chief Executive Officer of Lyf Pay. “By uniting leading retailers and financial services companies, such as BNP Paribas, Crédit Mutuel, Auchan, Total, Mastercard and Oney, our solution will play an ever-increasing role in the day-to-day lives of consumers.”

The alliance will also enable the partners to develop and test new concepts, taking advantage of the variety of banners within the Casino Group, and to offer new cross-market solutions thanks to the different markets targeted by Lyf Pay.

“This new phase sees strategically related partners investing together to provide a mobile payment solution for their customers, who are looking for an increasingly seamless and all-inclusive shopping experience,” said Thierry Laborde, Deputy Chief Operating Officer and Head of Domestic Markets at BNP Paribas.

“The smartphone is central to everyday consumer life,” said Daniel Baal, Chief Executive Officer of Crédit Mutuel Alliance Fédérale. “This agreement rounds out the services offered through the Lyf Pay app, with payment in-store and online, digitalised loyalty services, friend-to-friend payment, donations, contactless payment and, in the very near future, online fundraising/group gifting and expense sharing. In short, it’s an all-in-one solution that our customers and members can enjoy by signing up easily and directly via the Crédit Mutuel and CIC mobile apps.